Alibaba Nz Gst

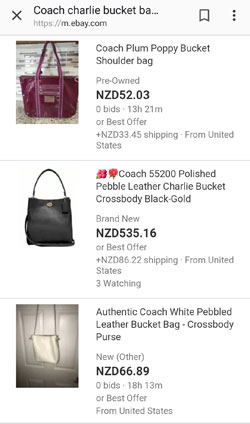

The supply of service would be taxable if the. On 1 December 2019 the new low-value goods regime will begin imposing goods and services tax GST at 15 on goods acquired by New Zealand consumers from offshore suppliers.

Questions Raised Over Alibaba Owned Aliexpress Treatment Of Local Gst Nz Herald

At least 5 by value of the supplies made by the recipient in a 12-month period are non-taxable.

Alibaba nz gst

. GST on Aliexpress Alibaba and other overseas purchase. Offshore suppliers would be required to register for GST in New Zealand file GST just like any other business in New Zealand. Alibaba and e-Bay are expected to comply. The GST charge will level the playing field for local retailers struggling to compete against foreign firms that have a 15 tax advantage.This will not change. Online items that cost more than NZ1000. The delivery time from New Zealand takes longer compared to Option A. Allow me to take you through the process of starting your importation from China to New Zealand using Alibaba.

Questions raised over Alibaba-owned AliExpress treatment of local GST 24 Jun 2020 0528 AM 4 minutes to read Shopper thought GST he paid on AliExpress was going to. Retail NZ which represents Kiwi shop owners says it would be very disappointed if the Government bowed to pressure to allow one more GST-free Christmas for internet shoppers. For example while GST for Australia has to be applied on a consignment basis IE on a basket of goods New Zealands proposal is for it be applied on an item-by-item basis. Now the New Zealand GST legislation may deem sales you make online to customers in New Zealand to be made in New Zealand if they are distantly taxable goods.

First from your factory to New Zealand and then again when sending your goods to your overseas customers. Note for others this new Download Invoice button is next to Confirm Goods Received button on the order details page and when you hit it a dialog opens just click the Receipt link hiding at the bottom of the introductory paragraph no need to enter anything or click the submit button. This leaves online shoppers wondering which items are worth ordering on foreign websites such as Amazon Alibaba and eBay especially when you take into account shipping costs. The new regime will apply to goods with an individual value of NZ1000 or less and will require the following.

This is an online site that allows you to engage with different suppliers for the supply of your goods. GST on imported services. Ad 25 Million Prequalified Suppliers 4000 Deals Daily. Offshore and NZ marketplaces such as Amazon ebay.

Revenue Minister Stuart Nash said that many New Zealand small businesses compete with foreign companies that sell exactly the same products in our market without collecting the GST. One of the ways you can import from China to New Zealand is through Alibaba. These new rules will apply from 1 December 2019. Ad 25 Million Prequalified Suppliers 4000 Deals Daily.

This would mean if you make such sales to New Zealand based customers in excess of 60000 in a 12 month period you will need to register for GST in New Zealand and account for GST at 15 on your sales. From October 2019 overseas purchases from Aliexpress Alibaba and other overseas suppliers will be adding GST on goods valued under 1000. GST on low-value goods starting from 1 December 2019. The New Zealand NZ government has now enacted the Taxation GST Offshore Supplier Registration Act 2019 introducing a requirement for offshore companies selling low value imported goods to NZ consumers to register for and charge NZ Goods and Services Tax GST.

GST is payable on all goods bought in New Zealand including overseas online purchases such as books bought on Amazon or Book Depository or goods from Alibaba and eBay. Youll need to pay duties and GST in New Zealand as you must first import the goods before you ship them out. From that date offshore suppliers selling goods with a total value of less than NZ400 to New Zealand consumers will have to register and collect GST if their total sales to New Zealand consumers exceeds NZ60000 a year. Alibabas director of government relations corporate affairs and marketing for Australia and New Zealand James Hudson said dealing with technical differences would require substantial additional investment.

However we do charge Duty and GST for alcohol and tobacco products regardless of value. Currently GST is collected for items over 400 at border entry along with any import duty and customs fee. Services supplied by a non-resident supplier to New Zealand resident recipient are treated as a supply of services in New Zealand and therefore subject to GST if. If you buy items from overseas for over NZ1000 we collect GST andor Duty and you must apply for a Customs Number.

Hence price will increase on all overseas purchase. Importing from Alibaba to New Zealand. Order items for over NZ1000 arrange transport to NZ and apply for a Customs Number.

How New Gst Rules Will Increase Your Online Shopping Bill Rednews

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/7FH524LT7NB52CKESEIQ4TYKFQ.jpg)

Questions Raised Over Alibaba Owned Aliexpress Treatment Of Local Gst Nz Herald

Gst On Aliexpress Alibaba Or Imported Goods From October 2019 Swift Accounting Christchurch

Veiled Threats By Ebay And Alibaba That They Could Be Forced To Go Offline If The Government Doesn T Give Them More Time To Get Ready To Start Paying Gst Met With Scepticism

Maps Travel Times Great New Zealand Touring Route North Island New Zealand Time Travel North Island

Gst On Aliexpress Alibaba Or Imported Goods From October 2019 Swift Accounting Christchurch

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/ZRHASXLLWPJSLG7ATCYTF47MNQ.jpg)

Amazon Alibaba Ebay And Etsy May Block Australian Users If Gst Changes Go Ahead Nz Herald

How To Sell Successfully On Alibaba A Step By Step Guide Finder Nz

GST is payable on all goods bought in New Zealand including overseas online purchases such as books bought on Amazon or Book Depository or goods from Alibaba and eBay. The new regime will apply to goods with an individual value of NZ1000 or less and will require the following.

Questions Raised Over Alibaba Owned Aliexpress Treatment Of Local Gst Nz Herald

Youll need to pay duties and GST in New Zealand as you must first import the goods before you ship them out.

Alibaba nz gst

. However we do charge Duty and GST for alcohol and tobacco products regardless of value. Alibabas director of government relations corporate affairs and marketing for Australia and New Zealand James Hudson said dealing with technical differences would require substantial additional investment. First from your factory to New Zealand and then again when sending your goods to your overseas customers. From that date offshore suppliers selling goods with a total value of less than NZ400 to New Zealand consumers will have to register and collect GST if their total sales to New Zealand consumers exceeds NZ60000 a year.Alibaba and e-Bay are expected to comply. Retail NZ which represents Kiwi shop owners says it would be very disappointed if the Government bowed to pressure to allow one more GST-free Christmas for internet shoppers. Ad 25 Million Prequalified Suppliers 4000 Deals Daily. These new rules will apply from 1 December 2019.

From October 2019 overseas purchases from Aliexpress Alibaba and other overseas suppliers will be adding GST on goods valued under 1000. This is an online site that allows you to engage with different suppliers for the supply of your goods. Offshore suppliers would be required to register for GST in New Zealand file GST just like any other business in New Zealand. Questions raised over Alibaba-owned AliExpress treatment of local GST 24 Jun 2020 0528 AM 4 minutes to read Shopper thought GST he paid on AliExpress was going to.

The New Zealand NZ government has now enacted the Taxation GST Offshore Supplier Registration Act 2019 introducing a requirement for offshore companies selling low value imported goods to NZ consumers to register for and charge NZ Goods and Services Tax GST. One of the ways you can import from China to New Zealand is through Alibaba. Order items for over NZ1000 arrange transport to NZ and apply for a Customs Number. This will not change.

If you buy items from overseas for over NZ1000 we collect GST andor Duty and you must apply for a Customs Number. Offshore and NZ marketplaces such as Amazon ebay. This would mean if you make such sales to New Zealand based customers in excess of 60000 in a 12 month period you will need to register for GST in New Zealand and account for GST at 15 on your sales. Note for others this new Download Invoice button is next to Confirm Goods Received button on the order details page and when you hit it a dialog opens just click the Receipt link hiding at the bottom of the introductory paragraph no need to enter anything or click the submit button.

Hence price will increase on all overseas purchase. Revenue Minister Stuart Nash said that many New Zealand small businesses compete with foreign companies that sell exactly the same products in our market without collecting the GST. Now the New Zealand GST legislation may deem sales you make online to customers in New Zealand to be made in New Zealand if they are distantly taxable goods. Currently GST is collected for items over 400 at border entry along with any import duty and customs fee.

GST on imported services. Online items that cost more than NZ1000. GST on low-value goods starting from 1 December 2019. The GST charge will level the playing field for local retailers struggling to compete against foreign firms that have a 15 tax advantage.

Ad 25 Million Prequalified Suppliers 4000 Deals Daily. For example while GST for Australia has to be applied on a consignment basis IE on a basket of goods New Zealands proposal is for it be applied on an item-by-item basis. The delivery time from New Zealand takes longer compared to Option A. GST on Aliexpress Alibaba and other overseas purchase.

Importing from Alibaba to New Zealand. Allow me to take you through the process of starting your importation from China to New Zealand using Alibaba. This leaves online shoppers wondering which items are worth ordering on foreign websites such as Amazon Alibaba and eBay especially when you take into account shipping costs. Services supplied by a non-resident supplier to New Zealand resident recipient are treated as a supply of services in New Zealand and therefore subject to GST if.

How New Gst Rules Will Increase Your Online Shopping Bill Rednews

Gst On Aliexpress Alibaba Or Imported Goods From October 2019 Swift Accounting Christchurch

How To Sell Successfully On Alibaba A Step By Step Guide Finder Nz

Gst On Aliexpress Alibaba Or Imported Goods From October 2019 Swift Accounting Christchurch

Maps Travel Times Great New Zealand Touring Route North Island New Zealand Time Travel North Island

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/ZRHASXLLWPJSLG7ATCYTF47MNQ.jpg)

Amazon Alibaba Ebay And Etsy May Block Australian Users If Gst Changes Go Ahead Nz Herald

Veiled Threats By Ebay And Alibaba That They Could Be Forced To Go Offline If The Government Doesn T Give Them More Time To Get Ready To Start Paying Gst Met With Scepticism

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/7FH524LT7NB52CKESEIQ4TYKFQ.jpg)

Questions Raised Over Alibaba Owned Aliexpress Treatment Of Local Gst Nz Herald

Post a Comment for "Alibaba Nz Gst"